Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“Second-guessing Tony Pidgley, chairman of Berkeley Homes, is usually unwise and investors appear to be taking his forecast that profits have peaked at the house builder more seriously today than when he first made it back in December,” says Russ Mould, AJ Bell Investment Director.

“Berkeley’s focus on high-end properties in the South East means it is far from typical within its peer group – just 4% sales (157 houses) were supported by the Help-to-Buy scheme – but this is a less-than-ideal start to a big month for results from house builders, whose shares have already been coming under pressure.

“Attention will now switch toward the scheduled results statements and trading updates due from Persimmon on 5 July, Barratt on 11 July and Taylor Wimpey on 31 July.

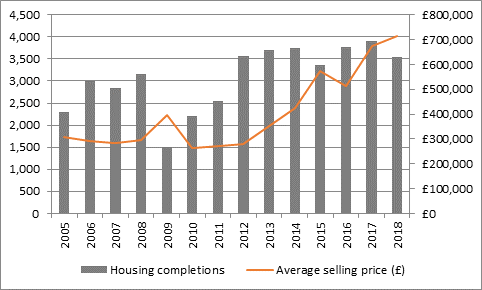

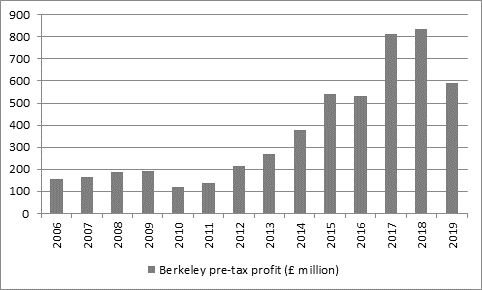

“Decreases in the forward sales book and housing completions did not stop Berkeley’s profits going up for the year to April, thanks to another jump in average selling prices but prices slipped slightly in the second half, from £719,000 to £715,000 and Mr Pidgley now expects profits to drop by around a third in the year to April 2019.

Source: Company accounts for financial year to April

“This may explain why the chairman, as well as managing director Rob Perrins, finance director Richard Stearn and four other executive or non-executive directors were all sellers of stock in the second half of 2017, even as the shares marched higher.

Source: Company accounts, Digital Look, analysts’ consensus forecasts. Company financial year to April

“Berkeley’s caution on the macroeconomic outlook, as well as the impact of higher raw materials costs which have stuck in the wake of the pound’s post EU-referendum plunge in 2016-2017, is reflected in a decision not to expand its land bank to any great degree

“The company did acquire 12 new sites during its fiscal year and gained eight new planning consents. But that increased the number of available plots by just 1% to 46,867, the slowest rate of growth since 2013 (when the land bank declined slightly).

“History shows that when Pidgley acts, markets should listen. Berkeley sold land and houses in the late 1980s in the view that the housing market had overheated and was vindicated by the vicious downturn of 1990-92, when the company began to build up its land bank once more, to the benefit of its balance sheet and shareholders alike. Berkeley isn’t selling now but it is not seem to be a huge net buyer either.

“Income investors may still look toward Berkeley for its plan to return 700p per share via dividends and share buybacks by September 2021, adding to the 934p per share already handed over.

“However, the mix between buybacks and dividends remains fluid and Berkeley’s management does say that it ended its financial year in April with a £687.3 million net cash balance, some £400 million above what it views as the normal requirement.

“The fact that this cash will not be returned to shareholders and instead will retained as a back-up adds to the view that Mr Pidgley and colleagues are cautious on the near-term outlook for the housing market – or at least their niche within in – and the wider British economy.”

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05

- Wed, 20/03/2024 - 16:30