Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“Sainsbury’s chief executive Mike Coupe may have been caught singing ‘We’re in the Money’ when his guard was temporarily down but Tesco boss Dave Lewis must be feeling equally pleased with himself after the first-quarter sales figures,” says AJ Bell Investment Director Russ Mould.

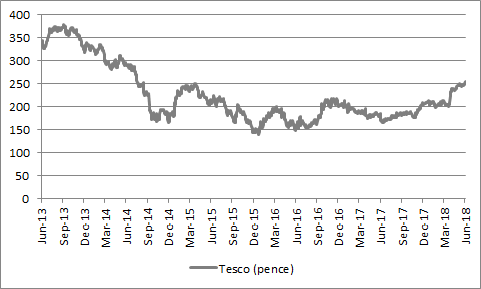

“Sales grew on a like-for-like basis for the tenth straight quarter on a group-wide basis, and also in the vital UK market, while the shares are trading at their highest level since summer 2014.

Source: Thomson Reuters Datastream

“Booker’s contribution of 14.3% like-for-like sales growth will have particularly pleased investors as Tesco gets down to the task of integrating its £4 billion purchase, to make the most of cost and also sales benefits.

“However, they will also be happy to see another solid performance from the UK operation, where sales rose 2.1% on a like-for-like basis.

“The dark days of 2013-15 now seem to be behind it, as Tesco continues to invest in both product (via an overhaul of its own-brand offerings) and price, in a bid to combat the threat posed by the discounters, Aldi and Lidl, as well as ongoing competition from Sainsbury, Morrison, Asda and online rivals such as Ocado.

Source: Company accounts

“To the surprise of many, who will have written off the sector’s prospects owing to the price-crushing assault of the discounters, the Food & Drug Retail sector as a whole appears to be thriving. It is the fourth-best performing sector (out of 39) within the FTSE All-Share in 2018 to date.

| Performance in 2018 to date | ||

| 1 | Automobiles & Parts | 43.4% |

| 2 | Technology Hardware & Equipment | 34.3% |

| 3 | Industrial Metals & Mining | 33.0% |

| 4 | Food & Drug Retailers | 26.3% |

| 5 | Chemicals | 16.6% |

| FTSE All Share | 0.6% | |

| 35 | Household Goods & Home Construction | (10.4%) |

| 36 | Software & Computer Services | (18.3%) |

| 37 | Mobile Telecoms | (18.3%) |

| 38 | Fixed Line Telecoms | (22.2%) |

| 39 | Tobacco | (24.9%) |

Source: Thomson Reuters Datastream. To the close on Thursday 14 June.

“This is in large part due to Ocado’s stunning rise, as its new licensing deals have persuaded investors to buy into the theory it is a software firm rather than grocer, or have at least squeezed the pips out of the short-sellers who disagree(d).

“But all of the majors have outperformed the FTSE All-Share in 2018, to suggest that their restructuring efforts are paying off, as earnings improve and dividends start to rise again (at least at Tesco and Morrison), while further consolidation in the sector after the Sainsbury-Asda deal is clearly been seen as a potential positive.”

| Performance in 2018 to date | |

| Ocado | 168.1% |

| Sainsbury | 30.4% |

| Tesco | 19.4% |

| Morrisons | 12.0% |

| UDG | 6.5% |

| SSP Group | (5.1%) |

| Clinigen | (13.2%) |

| McColls Retail | (15.9%) |

| Greggs | (27.2%) |

| Crawshaw | (38.7%) |

| Conviviality Retail * | (74.9%) |

Source: Thomson Reuters Datastream. To the close on Thursday 14 June. *Shares suspended and cancelled upon administration on 8 May 2018.

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05

- Wed, 20/03/2024 - 16:30