Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“A sharp jump in Marks & Spencer’s shares this morning means that the retailer got its news management right, by releasing the details of big store closures ahead of its results, but the numbers themselves are nothing to be proud of and show just how much work there is still to be done,” says AJ Bell Investment Director Russ Mould.

“At least the accelerated pace of change suggests that chairman Archie Norman is just starting to get going and help chief executive Steve Rowe with the tough decisions that need to be made. However even Mr Rowe admits that it is going to be a long haul, as the goal now is to deliver sustainable, profitable growth ‘within three to five years.’

“Investors now have to decide whether that’s too long to be left waiting at the check-out. At least an unchanged dividend of 18.7p per share equates to a dividend yield of around 6% (the twelfth highest yield in the FTSE 100 based on ordinary dividends alone), so patient holders may resist the temptation to throw in their M&S Homeware towel, at least for now.”

“Two things, however, do show how tough trading is at M&S.

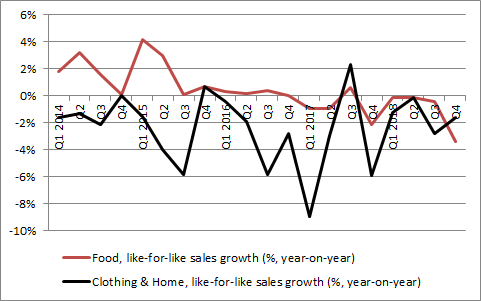

“The first is the dismal trend in like-for-like sales growth at both Food and Clothing & Home. Food sales fell for the fifth straight quarter and the decline at Clothing and Home reaccelerated after three quarters of almost coming in flat. Even allowing for the vagaries of Britain’s weather this is undeniably disappointing.

Source: Company accounts

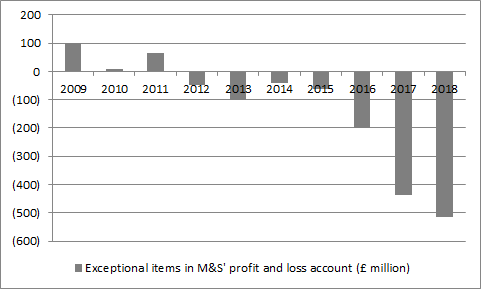

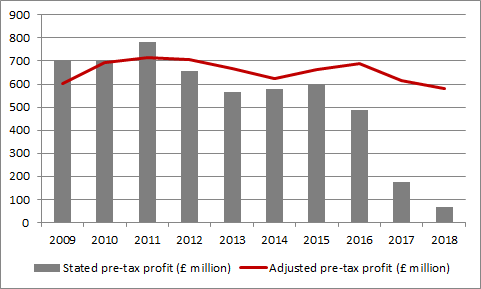

“The second is the yawning gap between the reported, or statutory, profit numbers that M&S is obliged to publish under current accounting rules and its own, ‘adjusted’ numbers – which effectively cut out the bad stuff, such as the cost of closing stores, overhauling IT and logistics and even some compensation costs related to the mis-selling of Payment Protection Insurance (PPI) at its financial services arm.

“These costs came to £514 million in the year to March 2018, higher than the £437 million hit taken in 2017. For management to claim these costs are ‘exceptional’ now looks a little rich, given that this is the third year in a row they have occurred, after the £200 million in so-called exceptionals in 2016.

“The word exceptional suggests ‘unusual’ yet these costs are now nothing of the sort – and M&S’ profits would have looked very different had the company managed its costs properly over the last five to ten years, swallowing these efficiency costs over that period as part of the cost of doing business, rather than taking them in one or two big dollops and then trying to pretend they are unusual.

“M&S has now taken ‘exceptional’ charges in each of the last seven years at total cost to the profit and loss account – and thus shareholders – of £1.4 billion.

Source: Company accounts

“One positive sign for shareholders going forward would therefore be a reduction in these supposedly exceptional costs and a closing of the gap between reported and adjusted numbers. That would point to the potential for improvement in performance and that the quality of profits could be improving as well as the quantity.

Source: Company accounts

“M&S can be fixed and its goal of generating one-third of sales from its online operations is feasible. After all, Next now derives more than half of its profits from its online business.

“However, there is a difference between the two businesses.

“Next has an incredibly clear view of who its customers are, what they want and how much they can – or are prepared – to pay.

“For all of Mr Rowe’s talk of ‘Mrs M&S’, his firm still gives the impression it lacks that total clarity of vision, on product, quality and price points after multiple changes of management at the Clothing & Home arm. There is time to resolve the unit’s woes and Mr Rowe and Mr Norman are showing additional urgency, judging by the latest huge restructuring charge.”

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05

- Wed, 20/03/2024 - 16:30