Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“Next’s 54-page-long results release is a whopper but it is what is missing from the statement that matters more than what is in it – there is no profit warning, there is no dividend cut and there is no sense of panic,” says AJ Bell Investment Director Russ Mould.

“Instead, investors are getting a clear analysis of the challenges which face the retailer and a detailed study of its strategic responses, in terms of online investment, improved stock availability and how the company intends to manage its store estate. If only all companies were as transparent as this.

“The news that Next generates £1.9 billion of sales via the internet (or 46% of the group total) and makes £426 million in profit from its digital channels (or 59% of the group total), including financing, should also help to reassure anyone frightened that the company is failing to adapt to the digital world – even if boss Simon Wolfson admits it is investing heavily here and has more to do.

“It is interesting to note that Lord Wolfson and his team are not only confident that last year’s stock availability issues are behind them, but that rising costs, a squeeze on consumers’ real incomes and the shift in spending from ‘stuff’ to experiences are cyclical trends which may start to come to an end in the year ahead. Not everyone may agree, but the rise in the pound should restrain import costs and help to put a lid on inflation, so sterling could become a good friend of Next’s if it keeps rising in 2018.

“Nevertheless, the company does not shirk the issue of how consumers continue to move online and the stress test of a 10% like-for-like drop in sales at its stores shows that Next sees this as a structural and not a cyclical issue.

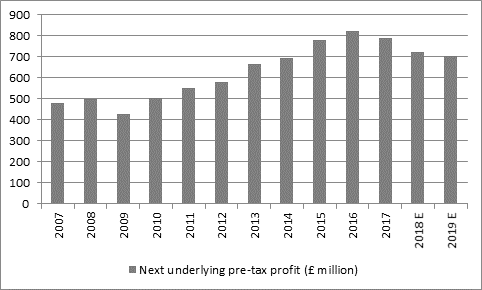

“For all of its hard work on costs and online services, a forecast for pre-tax profit of £705 million for the year to January 2019 does imply a third straight year-on-year drop from Next, even if management expects earnings per share to rise, helped by a lower share count after the recent buyback programme.

Source: Next company accounts, Digital Look, analysts’ consensus forecasts. Year to January.

“This is unlikely to stir growth and momentum-seekers’ blood but even the most ardent bear would struggle to argue that a company making more than £700 million a year is broken, especially when its brand is still so strong.

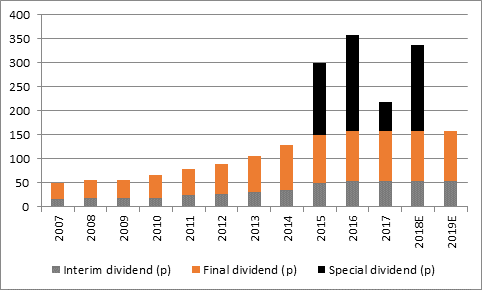

“Next also remains very cash generative and this cash flow also underpins dividend forecasts. Next may not repeat the 180p-a-share in special dividends for fiscal 2017-18 but even an unchanged regular dividend of 158p would represent a perfectly respectable yield of 3.2% more than twice covered by earnings per share.

Source: Next company accounts, Digital Look, analysts’ consensus forecasts

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05

- Wed, 20/03/2024 - 16:30