Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“The combination of rising sales, a healthy jump in pre-tax profits, lower debt, an increased ordinary dividend and even a special dividend of 4p sounds very appealing but investors are still declining to stock up on shares in Morrison,” says AJ Bell Investment Director Russ Mould.

“One reason for this is that operating profit fell year-on-year, while all of the profit uplift came from lower financial charges owing to the hard work Morrisons has put in to reducing its debt pile.

“Lower debt means less risk, and that is a good thing, but investors may want to see earnings from the grocer’s core day-to-day operations rise before they take a view that the company really is seeing off the threat posed by the discounters Aldi and Lidl, let alone more established rivals such as Tesco, Sainsbury and Asda.

“After all, Morrison’s operating margin slipped a little, from 2.9% to 2.7%, to suggest the competition remains as brutal as ever.

“This may also mean that the overall strong showing of the Food & Drug Retailers sector in 2018 is a little deceptive. To date, only 11 of the 39 industrial groupings which make up the FTSE All-Share are showing a gain this year and Food & Drug Retailers is one of them.

Best FTSE All-Share sectors, 2018 to date |

Performance |

Technology Hardware |

37.3% |

Autos & Parts |

30.8% |

Industrial Metals |

20.9% |

Industrial Transportation |

9.5% |

General Industrials |

7.6% |

Chemicals |

5.7% |

Aerospace & Defence |

4.6% |

Food & Drug Retailers |

3.5% |

Health Care Equipment & Services |

2.9% |

Forestry & Paper |

2.7% |

Source: Thomson Reuters Datastream, 1 January to 12 March 2018

“However, closer analysis of the sector shows that virtually all of this gain comes from one stock, Ocado, where software licensing deals have given some credence to the view that it is really a technology company and not a grocer, while putting bears and short-sellers of the stock to flight at the same time.

|

Performance in 2018 * |

Ocado |

48.7% |

UDG Healthcare |

2.5% |

Morrison |

1.4% |

Tesco |

0.5% |

Sainsbury |

(0.2%) |

McColl’s Retail |

(8.0%) |

SSP Group |

(8.4%) |

Clinigen |

(8.7%) |

Greggs |

(13.1%) |

Crawshaw |

(44.4%) |

Source: Thomson Reuters Datastream, *1 January to 14 March 2018 at 09:00

“For all of the improvement in like-for-like sales growth, highlighted by recent figures from consultants Kantar Worldpanel, the discounters remain a key threat and the difficulties of France’s Carrefour in getting its margins to expand show that there may still be much more work to be done.

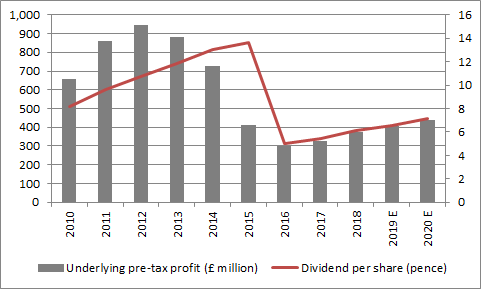

“Nevertheless, Morrison’s boss David Potts and his team can look back on what they have achieved with some satisfaction, especially as they have cut net debt by so much and got sales, profits and dividends all growing again.

Source: Company accounts, Digital Look, analysts’ consensus forecasts. Financial year to January.

“Best of all, the reduction in debt and the massive pension surplus, means Morrison’s – and its shareholders – can hunker down for a long fight without having to worry about the interest bills it owes to its banks.

“Operating profit of £458 million and interest income of £5 million compare to £65 million of interest expense, for interest cover of 7.1 times – when any figure above two usual gives grounds for comfort.

“In addition, earnings per share of 13p covers the ordinary 6.09p dividend by more than two times, to again suggest the payment is sustainable.

“The company also has strong asset backing, with tangible fixed assets of £7.2 billion on its balance sheet. That compares to a market capitalisation of £5.3 billion, net debt of £973 million and the £594 million pension surplus for an Enterprise Value of £5.7 billion.

“That is likely to keep patient value-seekers interested, especially as the dividend is growing once more.”

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05

- Wed, 20/03/2024 - 16:30