Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

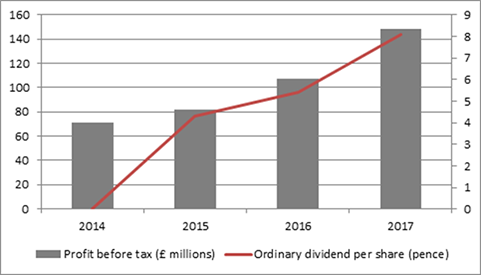

“Better-than-expected full-year profits, a 50% increase in its dividend to 8.1p and a £100 million special dividend (worth around another 21p per share) mean that Upper Crust-owner SSP is providing investors with a feast of good news today and the shares are up strongly to a new all-time high as a result,” says AJ Bell Investment Director Russ Mould.

Source: Company accounts

“SSP’s success shows the importance of pricing power for companies. If a firm can put price hikes through – or even hold prices - with a minimum of fuss it has a potentially great business but if it can’t the business model may be weak and the company one to avoid.

“Pricing power can come from strong brands, market share, a technological edge or an installed base of kit but SSP has a different recipe – a captive audience.

“Through its Ritazza and Upper Crust outlets, and also franchise agreements with big names like Starbucks and Yo! Sushi. SSP provides food at train stations and airports where ever-rising numbers of hungry (and frequently delayed) travellers are in need of sustenance, especially as fewer airlines are making an effort when it comes to on-board catering.

“Two-thirds of sales are generated overseas as the group expands in North America and Asia – so the pound’s weakness is a bonus – while chief executive and former WH Smith boss Kate Swann can be relied upon to keep costs tight for good measure.

“The only chewy issue now is the stock’s valuation. The shares have doubled in the past year to leave them on a forward price/earnings ratio for the year to September 2018 of 30 times compared to a rating of around 15 times for the UK market as a whole.

“Even though consensus earnings and dividend forecasts are likely to move higher, that does price in a lot of good news and means the company must continue to deliver upside surprises on profits to keep its momentum-hungry shareholders happy.”

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05

- Wed, 20/03/2024 - 16:30