Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“Tesco’s shares are below where they were a year ago (despite a 6% advance in the FTSE 100 over the same period) and today’s results show why, even if investors will be delighted to see the company reinitiate dividend payments with an interim cash distribution of 1p per share,” says AJ Bell Investment Director Russ Mould.

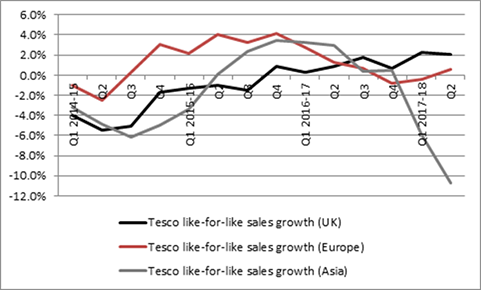

- “Trading slowed a little in the UK, as like-for-like sales growth slipped to 2.1% year-on-year from 2.3% (mirroring a similar slight deceleration at Morrisons).

Source: Company accounts

- “Competition remains hot, as shown by Tesco’s emphasis on minimal price increases. It remains to be seen how much pressure Tesco is passing down the chain of suppliers in this environment (and the company makes no reference to the chicken supply investigation by two national media outlets, even though the 2013 horse meat scandal turned out to be one indication of margin and profit stress at the company).

- “While net debt continues to rattle lower, falling to £3.3 billion from £4.4 billion a year ago (and £8.5 billion when Dave Lewis took over as boss), the company still has lease obligations of £7.3 billion and a £2.4 billion pension deficit

- “The company is still waiting for the latest phase of the Competition and Markets Authority review of its planned £3.7 billion merger with wholesaler Booker. A final decision on the deal is now expected by Christmas. Two major shareholders have questioned the merits of the transaction, which could add a great deal of complexity to the ongoing Tesco turnaround programme. In addition, the price paid looks very full and the track record of merger and acquisition deals delivering all of the targeted benefits is poor (and Tesco’s own history here is particularly spotty).

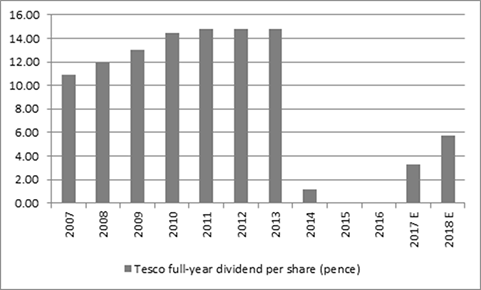

“Nevertheless, boss Dave Lewis will be understandably pleased to point to falling debt, rising profit margins and the return to the dividend list. The 1p interim payment helps to underpin the consensus forecasts of a full-year payment of some 3.3p, rising to 5.8p next year.

“Management’s long-run ambition to offer a dividend that is covered 2.0 times by earnings per share looks perfectly sensible, even if the prospective 1.7% yield on offer for this year may not be enough to excite income seekers just yet.”

Source: Company accounts, Digital Look, consensus analysts’ forecasts

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05

- Wed, 20/03/2024 - 16:30