Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

A third profit warning in four months is knocking a huge hole in the share price of Safestyle, as the PVC windows maker flags weaker-than-expected order intake. Pubs group Greene King will also have its shareholders looking for a stiff drink this evening as a statement ahead of its Annual General Meeting warns of cooling demand for food across its estate.

“It is always tempting to dismiss one company profit warning, or even two or three, as down to ‘company-specific’ problems and Greene King is doing its best to blame the rotten summer weather. But Safestyle remains convinced that it is still taking market share so this one is harder to explain away and it may be more than a coincidence that two firms which rely heavy on consumer spending have both released weak updates today, especially as the weak update from Greene King follows a warning earlier in the week from fellow casual dining chain Fulham Shore," says AJ Bell Investment Director Russ Mould.

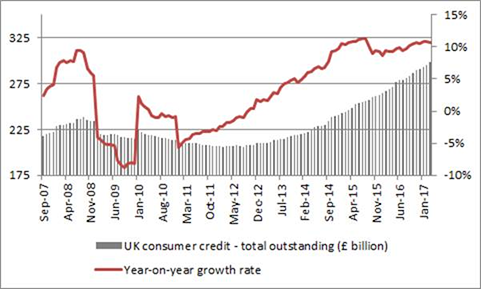

“Add to this picture an ongoing slide in UK car sales and it requires little imagination to build a picture where weak wage growth and lofty levels of credit card debt are combining to depress consumer spending and confidence, to the potential detriment of growth across the wider UK economy. (see charts below)

“At the moment, it seems to be small-ticket discretionary items which are coming under pressure, such as home improvements and eating out, although the weakness in cars does hint that bigger-ticket purchases are also coming under closer scrutiny as consumers watch their outgoings more closely.

“Such a picture will hardly encourage the Bank of England to pull the trigger on an interest rate increase any time soon and it would be a massive surprise were the Monetary Policy Committee to even hint at an increase in headline borrowing costs at the meeting set for Thursday 14 September.”

Source: Thomson Reuters Datastream

Source: ONS

Source: GfK

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05

- Wed, 20/03/2024 - 16:30