Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

"Shoppers like value, particularly when times are tough, and it is therefore no surprise to see Primark continue to do drive profit forecast upgrades at Associated British Foods, whose full-year trading statement cites lower markdowns (and therefore higher margins) at the fast-fashion chain as the key reason for better-than-expected trading," says AJ Bell Investment Director Russ Mould.

"However, the shares are largely unmoved in early trading as investors ponder whether the stock offers quite the same value as the company’s clothing stores.

"AB Foods now expects (adjusted) operating profit will come in “well ahead” of last year’s £1.1 billion, although higher finance costs, owing to the effect of low interest rates and bond yields upon its pension fund, and an increased tax charge will mean that net profits and earnings per share will advance by a lesser rate.

"The FTSE 100 firm derives two-thirds of its earnings from overseas so renewed weakness in the pound means the company’s profits will benefit by £85 million from foreign currency translation benefits. Euro strength also helps the sugar operations but sterling’s slide against the dollar increases purchasing costs for Primark and will restrain margins a touch, even if at group level AB Foods now expects its full-year operating margin to exceed the 10% generated in the first half.

"As a further plus, disposals, strong than expected profits and inventory reduction mean that AB Foods will end the year with a net cash pile of £650 million, to offer further reassurance about the company’s financial and operational solidity.

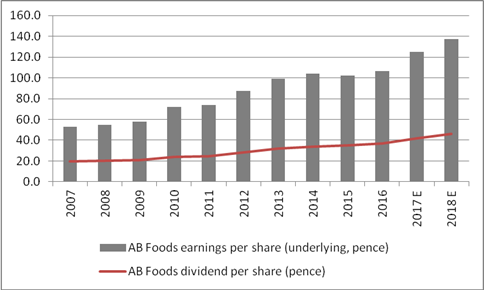

Source: Company accounts, Digital Look, consensus analysts’ forecasts

"However, AB Foods’ shares have run strongly from their February lows nearly £24 earlier this year and investors must therefore address three questions before queuing up to buy more stock:

- First, Primark’s sales growth may have been 20%, but currency movements added 7% and estate expansion 12%. Like-for-like growth was just 1%, a figure which does not necessarily excite (even if it still surpasses anything recently achieved by Next or M&S) and one which does not necessarily merit a growth stock rating. That said, Primark’s overseas expansion appears to be going well and the firm plans to add 19 more stores in fiscal 2017-18 to take the total to 364.

- Second, currency movements are unlikely to be less helpful in the new financial year. All other things being equal, AB Foods expects zero translation benefits and an ongoing negative impact on a transactional basis (Primark’s purchasing dollar costs).

- Third, the shares are not quite as cheap as they were.

- They peaked at £36 in December 2015 when analysts’ were forecasting earnings per share of 100p for the coming year – a price/earnings multiple of 36x

- They bottomed at £23.60 in February 2017, when analysts’ were forecasting EPS of 118p for the coming year – a price/earnings multiple of 20x

- The shares now change hands for £32.28, when the consensus EPS forecast for the new financial year is 137p – a forward multiple of 23.6x

"That near-24x rating looks cheap compared to the prior peak but with the current consensus calling for around 10% earnings growth in 2017-18 that means the valuation looks pretty full, at least in the near term, especially as currency gains are going to drop away, Primark’s like-for-like growth does not necessarily justify such a lofty multiple either and the FTSE 100 trades on 13.8x.

"At least there may be some upgrades to come and the net cash pile should help AB Foods to add to its proud record of consecutive annual dividend increases, which stretches back to 2000 and the firm is still churning out earnings growth at a time when Western economies are still growing at sub-trend levels, so the lofty valuation is at least a deserved reward for the company’s consistency."

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05

- Wed, 20/03/2024 - 16:30