Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

"A renewed focus on customer satisfaction and providing a quality product at a fair price is already reaping dividends at Bovis, as the FTSE 250 house builder targets higher-than-expected shareholder payouts for 2017 and 2018, as well as special dividends out to 2020," says AJ Bell Investment Director Russ Mould.

“Today’s interim results still bear the scars of a disastrous end to 2016, when Bovis sought to offer cash incentives to customers so they could complete house purchases and meet the profit targets that would have triggered bonuses for senior executives, notably former CEO David Ritchie.

“Mr Ritchie has since resigned and his successor, Greg Fitzgerald, is working on repairing the damage to customers’ homes, Bovis’ reputation and the firm’s profit and loss account.

“Completions fell 6% in the first half as the builder focused on quality rather than quantity and pre—tax profits fell 31%, thanks in part to £6.3 million in costs related to placating disgruntled buyers of Bovis homes.

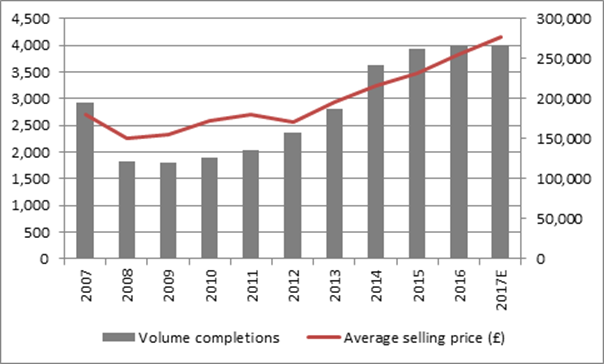

“The good news is that progress is being made with fixing the operational issues and Bovis expects to complete 4,000 homes this year – marginally ahead of last year and ahead of the company’s initial expectations.

Source: Company accounts. Average selling price is for first half of 2017.

“Such reassurance, coupled with a lowly net debt number, helps to explain the initial 7% jump in the shares today.

“Sentiment has also been boosted by Mr Fitzgerald’s plan to increase the dividend payment to 47.5p this year and 57p next, well ahead of consensus analysts’ forecasts of 45p and 46p respectively.

“That is enough to put Bovis on a yield of 4.2% for this year and 5% for next. On top of that, the company now intends to distribute special dividends worth £180 million, or 134p a share, out to 2020, sums which will take the yield into double-digits, depending upon how they are phased:

| 2017E PE (x) | 2017E Dividend yield (%) | Historic price/book (x) | |||

| Bovis | 15.3 x | Taylor Wimpey | 6.90% | Countryside Properties | 2.95 x |

| Countryside Properties | 13.0 x | Barratt Developments | 6.80% | Persimmon | 2.93 x |

| Persimmon | 10.7 x | Crest Nicholson | 6.20% | Berkeley Homes | 2.82 x |

| Taylor Wimpey | 10.2 x | Berkeley Homes | 5.20% | Redrow | 2.23 x |

| Barratt Developments | 10.0 x | Persimmon | 5.20% | Taylor Wimpey | 2.22 x |

| Redrow | 9.0 x | Bovis | 4.20% | Crest Nicholson | 1.96 x |

| Bellway | 8.8 x | Bellway | 3.80% | Bellway | 1.97 x |

| Crest Nicholson | 8.2 x | Redrow | 2.70% | Bovis | 1.50 x |

| Berkeley Homes | 7.9 x | Countryside Properties | 2.30% | Barratt Developments | 1.42 x |

| AVERAGE | 10.4x | 4.80% | 2.20x |

Source: Digital Look, consensus analysts’ forecasts.

“Such meaty yields could be seen as falling into the “too good to be true” category, even allowing for the sound balance sheet which has minimal debt. Were the housing market to decline and profits slide again, Bovis could still pay such dividends by perhaps sacrificing land purchases, although in the event of a downturn the firm would surely prioritise the purchase of cheap(er) plots, as this is one of the real keys to house builders’ long-term profitability.

“For the moment the eye-catching yield and potential for profit recovery are both likely to support the share price, especially as the internal dynamic means Bovis could provide earnings growth rates which outstrips those on offer from its peers.

“The stock looks expensive on earnings – but then profits are depressed after last year’s problems and it looks attractive on a yield basis, especially once the special dividends are thrown in.

“The shares also look cheap on price-to-net-asset-value, again as a result of last year’s operational miscues and that discount should disappear if Bovis can prove it is putting its house in order.

“The final few months of the year should be a good test of the Fitzgerald regime. The company has already secured 96% of 2017’s sales – it had secured over 90% as of this time last year and then made a mess of it. Delivery this year would draw a clear line under 2016’s woes.”

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05