Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“Analysts and economists continue to fret about Brexit but strong full-year results from builder Redrow make it clear that people still need homes to live in, whatever the political situation,” says Russ Mould, investment director at AJ Bell.

“Monday’s weak construction industry sentiment survey, or purchasing managers index (PMI), had stoked fears that a key engine of UK economic growth was stalling, but you would never guess this from Redrow’s upbeat statement today.

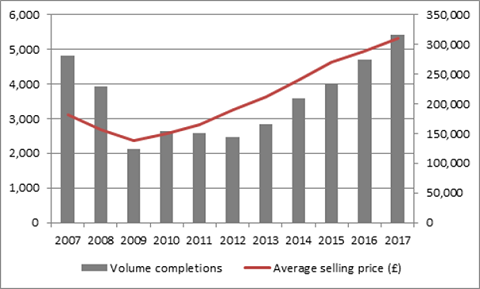

“Boss Steve Morgan unveiled record sales and pre-tax profits for the company, as well as 70% jump in the full-year dividend. Housing completions rose 15% and average selling prices by 7%:

Source: Company accounts

“Such reassuring numbers, coupled with a 14% jump in the order book to £1.1 billion, help to explain why shares in Redrow (and most of the other FTSE 100 and FTSE 250 house builders) have performed so strongly this summer, with Countryside Properties the only exception after a slightly guarded trading statement back in July.

“A very upbeat outlook statement also helps to justify the surge in Redrow’s shares to fresh highs above 600p (and therefore justify investors’ decision to reject a provisional attempt from Morgan to take the business private with a 152p-a-share offer back in 2012).

“Morgan raised the company’s 2020 guidance to £2.2 billion in sales, pre-tax profit of £430 million and a dividend of 32p.

“Those numbers compare to the £1.7 billion, £315 million and 17p recorded in the year just ended and on the closing share price of yesterday are enough to put the stock on a 5.2% dividend yield for 2020, something which may catch the eye of income-seekers.

“That valuation metric could tempt some, especially as Redrow is also one of the cheaper house builders based on earnings and asset value per share (even if its near-term yield compares less favourably to that offered by most of its FTSE 350 peers):

| 2017E PE (x) | 2017E Dividend yield (%) | Historic price/book (x) | |||

| Bovis | 14.1 x | Taylor Wimpey | 6.90% | Countryside Properties | 2.97 x |

| Countryside Properties | 13.1 x | Barratt Developments | 6.60% | Persimmon | 2.97 x |

| Persimmon | 10.9 x | Crest Nicholson | 6.30% | Berkeley Homes | 2.83 x |

| Taylor Wimpey | 10.3 x | Berkeley Homes | 5.20% | Taylor Wimpey | 2.24 x |

| Barratt Developments | 10.2 x | Persimmon | 5.10% | Redrow | 2.20 x |

| Redrow | 8.8 x | Bovis | 4.30% | Crest Nicholson | 1.94 x |

| Bellway | 8.8 x | Bellway | 3.80% | Bellway | 1.96 x |

| Crest Nicholson | 8.1 x | Redrow | 2.70% | Barratt Developments | 1.56 x |

| Berkeley Homes | 7.9 x | Countryside Properties | 2.30% | Bovis | 1.37 x |

| AVERAGE | 10.3x | 4.80% | 2.20x |

Source: Digital Look, consensus analysts' forecasts

“However, a valuation of around 2.0x historic book value is usually seen as pretty full for the house building sector, so a lot of good news does appear to be factored in already, especially after the summer share price surge.

“The question investors must therefore address is whether the industry’s excellent near-term profit momentum can be maintained. If so, asset valuations will continue to rise and the sector will look less expensive (and even cheap over time) and for the moment demand clearly continues to outstrip supply.

“But if the economy wobbles, consumers feel house prices are too high or borrowing costs start to crawl higher, possibly sometime after Brexit in 2019, the market could slow and leave builders looking like a pricey bet on a housing market which some already consider to be frothy.”

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05