Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

A recommendation from the management team at Hornby that investors shunt into the sidings a 32.375p-a-share offer from Phoenix Asset Management leaves shareholders with three possible options when it comes to rescuing something from a situation where there seems to be little light at the end of the tunnel for the Corgi, Humbrol and Airfix brands owner.

- Investors can take the money and run. Phoenix’s purchase of a 20.9% stake in the Kent firm from disappointed activist investor New Pistoia Income leaves it with a 55.2% stake and an obligation to make a bid for the shares it does not own. However the 32.375p paid to New Pistoia, and now offered to remaining investors, sits a fraction below the current 32.75p price and would lock in a big loss for many long-term holders – Hornby’s shares peaked at 281p in summer 2007:

Source: Thomson Reuters Datastream

- They can wash their hands of the whole affair and simply sell the shares. That would crystallise any paper losses and let someone else worry about whether Hornby’s management team or Phoenix’s fund managers have the skills to turn around the company’s ebbing fortunes. It would however free the investor from holding shares where there is one dominant institutional investor whose influence would likely overwhelm theirs (assuming the bid is rejected and the shares remain quoted).

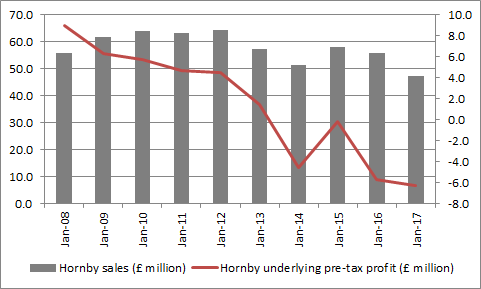

It would also put Hornby out of shareholders’ misery. The shares peaked over a decade ago and so did pre-tax profits, despite several attempts to broaden and rejuvenate the product range, cut costs and refinance the company. This perhaps drops a very heavy hint that the problems may not lie with management or the cycle but a more deep-rooted structural shift away from Hornby’s classic toys and toward video games played on consoles or simply online via smartphones, tablets and PCs.

Source: Company accounts

- They can reject the offer and give management a chance to prove their turnaround plan can work. This has three disadvantages. It leaves Hornby as a quoted company that has effectively been taken over, given Phoenix’s 55.2% stake. That in turn means investors will have to trust whether management and Phoenix can work together effectively to return Hornby to profit. And it means that investors will have to put their faith in yet another turnaround plan at the company, which has not paid a dividend since 2012 and already taken the step of selling and leasing back its Margate headquarters, sometimes (though not always) a sign that a firm is struggling for cash.

Even if chief executive Steve Cooke is new to the job, having only taken the reins in spring 2016, and longstanding chairman Roger Canham has now left, the long-term trajectory of profits and the share price suggest this could be a bold call, especially when you look at the headline attached to the last ten full-year results announcements. There have already been plenty of false starts at the Scalextric maker:

|

Year to March |

Results statement headline |

Sales (£ m) |

Pre-tax profit (underlying, £ m) |

|

2008 |

“Continues momentum” |

55.7 |

9.0 |

|

2009 |

“Brands gather momentum” |

61.7 |

6.3 |

|

2010 |

“Sales momentum builds” |

63.9 |

5.7 |

|

2011 |

“Unveils Star Wars licence as London 2012 merchandise gathers pace” |

63.4 |

4.7 |

|

2012 |

“Broadens product ranges” |

64.4 |

4.5 |

|

2013 |

“Continues to make progress” |

57.4 |

1.4 |

|

2014 |

|

51.6 |

-4.6 |

|

2015 |

“Makes significant progress during transformational year” |

58.1 |

-0.2 |

|

2016 |

“Announces turnaround plan” |

55.8 |

-5.7 |

|

2017 |

“Completion of first stage of turnaround plan” |

47.4 |

-6.3 |

Source: Company accounts

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05

- Wed, 20/03/2024 - 16:30