Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

"It might not be as exciting as picking an oil explorer or junior miner which makes a huge resource find and sends its shares gushing higher but investing is about keeping your money safe as much as it is making a return on it and today’s first-half trading update from Bunzl shows that the best long-term picks can be the dull ones," says AJ Bell Investment Director Russ Mould.

“Shares in the FTSE 100 support services firm are up 4% in early trading, placing them at the top of the leaderboard, after chief executive Frank van Zanten noted that organic sales growth has accelerated from 2% in the first quarter to 3% to 4% in the first half overall.

“That underlying progress was supplemented by acquisitions, which added another 3% to 4% to sales, and currency movements which increased sales by 12% on a constant currency basis.

“Bunzl supplies the things that other firms need in order to do business; but not items they would sell to their customers. For example, it supplies disposable coffee cups to cafes and food wrap to supermarkets to safety equipment and syringes for hospitals.

“It also supplements organic growth with bolt-on acquisitions – nothing too big, nothing too transformational or risky – and then improves the performance of the purchases, leading to increased profitability and cash flow. All of the deals are self-funded.

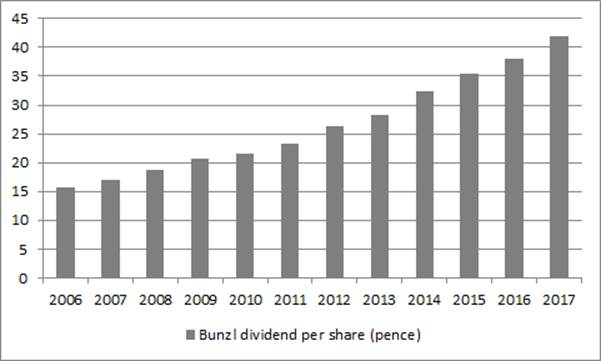

“The net result is Bunzl is one of just 27 FTSE 100 firms to have increased its dividend for all of the last 10 years consecutively (and its streak of increases actually stretches back 24 years):

Source: Company accounts

“As a result, since 1 June 2007,

- Shares in Bunzl are up by 215%, compared to an 11% advance in the FTSE 100

- The total return on Bunzl shares - capital gain plus dividends reinvested – is 306%, compared to 63% from the FTSE 100.

“If there is a knock on the stock it may be that the pace of acquisitions seems to be increasing.

“Bunzl has already made eight acquisitions in 2017, including three in the second quarter across Spain and Canada, at a total cost of £290 million, adding £370 million to revenues in the process:

Source: Company accounts

“The other key decision investors need to make concerns the stock’s valuation.

“At £24, the shares trade on 21.4 times earnings for 2017 with a 1.9% dividend yield – a big premium on an earnings basis to the wider UK market, which trades on around 15 times and a big discount on a yield basis, as the current overall UK yield is just under 4%.

“Investors must therefore decide whether it is worth paying up for Bunzl’s relatively dependable earnings and cash flows and especially that tremendous dividend growth track record, which has so far generated strong long-term total returns.”

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05