Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“Rising (adjusted) profits, falling debts and a planned return to the dividend list in 2017-18 all suggest that boss Dave Lewis’ planned turnaround at grocery giant Tesco is firmly on track,” says Russ Mould, AJ Bell's Investment Director.

“However, the shares seem underwhelmed today, amid ongoing doubts over the merits of the Booker deal and whether it will make fixing the group’s profit margin woes more difficult rather easier.”

“The good news from today’s Tesco full-year results came from:

- An increase in the (pre-exceptionals) operating profit to £1.28 billion from £1.02 billion a year ago, as Tesco grew like-for-like sales in the UK for the first time since 2009-10, cut costs, reduced its reliance on multi-buy promotions and worked on rejuvenating both its product ranges and its brand. As a result, pre-tax profit (pre-exceptionals) of £729 million broadly met analysts’ forecasts.

- A reduction in net debt to £3.7 billion from £5.1 billion (and £8.5 billion the year before) as profits and cash flow improved.

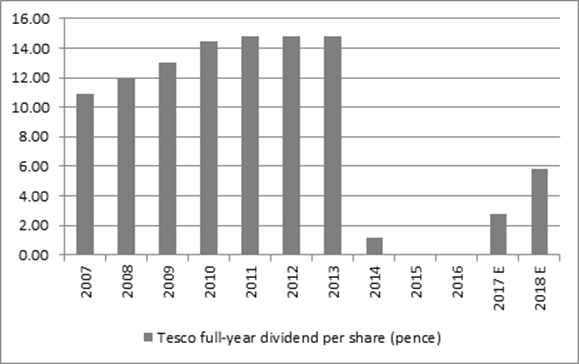

- The announcement of a planned return to the dividend list in fiscal 2017-18, after a two-year absence, with an intention to ensure that earnings cover the shareholder payout by a factor of two over the medium term.

Source: Company accounts, Digital Look, consensus analysts' forecasts

“However, the shares fell by nearly 3% to make them the worst performer on the day in the FTSE 100 in early trading. The absence of an upside surprise to earnings did not help but three other factors may also be weighing on sentiment:

- Like-for-like growth in the core UK business decelerated again in the fourth quarter, while Europe and Asia also put in flaccid showings. Any further loss of momentum could make it hard for Tesco to make the 3.5% to 4.0% operating margin ambition reiterated today by chief executive Dave Lewis for 2019-20, following the improvement to 2.3% from 1.8% in 2016-17.

- Tesco’s pension deficit more than doubled to £6.6 billion from £3.2 billion, undoing the benefit of the marked reduction in net debt from a balance sheet perspective and adding to the finance costs which still burden the profit and loss account.

- The merits of the planned £3.7 billion Booker deal remain open to fierce debate, given that the Tesco turnaround story has many moving parts and still has a long way to go even before the complications which come with integrating any deal, large or small (and the mess that Tesco made of both Giraffe and Dobbie’s Garden Centres suggests its record here is not as good as it could be).

Tesco is still a long way from its 3.5% to 4.0% operating margin ambition and most acquisitions fail to generate the revenue or cost benefits they promise, so Booker is by no means certain to help the FTSE 100 firm reach its goal.

“It is also depressing to see boss Dave Lewis justify the deal by citing “growth” without explaining growth in what. Many a takeover deal has been structured in a way that enhanced earnings per share but still destroyed shareholder value over the long term so the Tesco team will need a stronger justification that that when they make the case for the Booker deal to shareholders in both firms.”

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05

- Wed, 20/03/2024 - 16:30