Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

The markets cannot always be right (not least as it would be impossible for investors to make money from them if all securities were always appropriately priced and valued) but their views must always be respected.

As such, it is worth pondering what lessons can be drawn from the price action witnessed in the first quarter of 2017, to see what the market is telling us. Such analysis may also help to highlight where the markets may have made a mistake and got it wrong, presenting an opportunity to any investors who wish to take a pro-active approach to portfolio management.

Looking at the performance data across asset classes, sectors and geographies in total return, sterling-denominated terms three clear themes come to light:

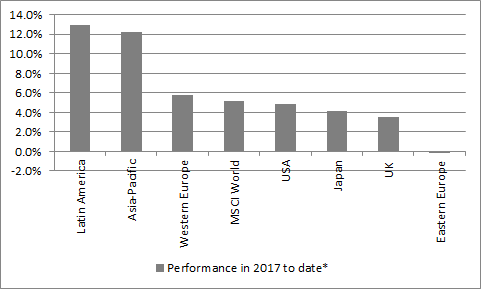

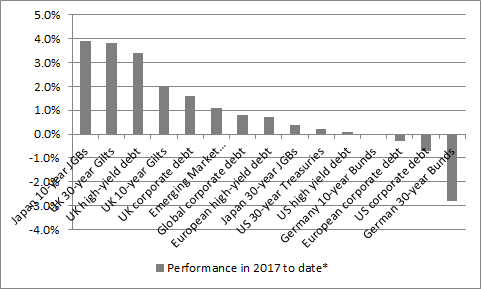

- First, the Trump ‘reflation trade’ retained its grip on the markets’ imagination. Stocks easily outperformed bonds and sentiment remained skewed to ‘risk on’, as evidenced by the outperformance of emerging markets within equities and long-dated, high-yield or emerging market debt within fixed income.

Global stocks beat global bonds hands down in the first quarter of 2017

Source: Thomson Reuters Datastream.

*To 3 April 2017.

Total returns, in sterling terms.

- Second, the picture became more nuanced as the quarter wore on and President Trump became entangled in first a visa row and then ultimately unsuccessful negotiations to get his healthcare reform bill through the House of Representatives.

US stocks underperformed the MSCI World equity index, perhaps finally reflecting how the American market looks expensive relative to its international peers as well as its own history.

Emerging markets lead the way for equity investors in the first quarter of 2017

Source: Thomson Reuters Datastream.

*To 3 April 2017.

Total returns, in sterling terms.

In addition, defensive sectors such as utilities began to do better and miners and financials began to do worse as Trump’s programme (and the dollar) lost a little momentum.

Cyclical sectors did not perform as well as might have been expected in the first quarter of 2017

Source: Thomson Reuters Datastream.

*To 3 April 2017.

Based on S&P 1200 Global indices. Total returns, in sterling terms.

- Third, bonds generally did well in the UK, on a global basis, while domestic equities generally did relatively poorly. The markets appear to have their doubts over the underlying robustness of the British economy and seem to be of the opinion that the Bank of England will be in no rush to raise interest rates as a result, whether this is the result of excess debt, doubts over Brexit or other factors.

The UK was a source of good performance for fixed-income fans in the first quarter of 2017

Source: Thomson Reuters Datastream.

*To 3 April 2017.

Total returns, in sterling terms.

Moreover, the dismal performance of energy stocks throughout the period, and the loss of momentum by both financial and mining stocks were all unhelpful trends for the UK equity market, given their dominance on the earnings and dividend forecasts of the FTSE 100, and improvement is required if domestic plays are to offer better returns across the rest of the year.

As emphasised in recent columns, banks, oils and miners are hugely important for the FTSE 100 (and by implication the whole UK market as the premier index represents around 85% of its total market capitalisation), as they dominate earnings and dividend – and earnings and dividend growth – forecasts for 2017 and 2018. If they perform poorly, all three could act as a drag on the UK’s headline indices.

The next table shows the 10 best and worst performing sectors in the FTSE All-Share this year so far:

The best and worst 10 performing equity sectors in the FTSE All-Share in 2017 to date

| Performance ranking in | ||||||

| Ranking | Performance in 2017 * | 2016 | 2015 | 2014 | ||

| 1 | Personal Goods | 17.5% | 14 | 20 | 22 | |

| 2 | Forestry & Paper | 17.3% | 8 | 4 | 20 | |

| 3 | Tobacco | 13.0% | 13 | 4 | 9 | |

| 4 | Electrical & Electronic Equipment | 11.7% | 12 | 19 | 32 | |

| 5 | Industrial Engineering | 10.3% | 4 | 35 | 36 | |

| 6 | Household Goods | 9.8% | 32 | 2 | 3 | |

| 7 | Autos & Parts | 9.4% | 22 | 31 | 28 | |

| 8 | Beverages | 8.6% | 20 | 14 | 24 | |

| 9 | Industrial Metals | 7.5% | 1 | 39 | 16 | |

| 10 | Pharma & Biotech | 5.8% | 24 | 26 | 10 | |

| 30 | Real Estate Investment Trusts | -0.4% | 35 | 17 | 2 | |

| 31 | Media | -0.8% | 23 | 8 | 19 | |

| 32 | Leisure Goods | -1.1% | 27 | 13 | 26 | |

| 33 | Food Producers | -1.5% | 35 | 15 | 5 | |

| 34 | General Retailers | -3.3% | 37 | 24 | 6 | |

| 35 | Food & Drug Retailers | -3.7% | 9 | 32 | 39 | |

| 36 | Electricity | -5.9% | 30 | 29 | 12 | |

| 37 | Technology Hardware | -7.8% | 7 | 21 | 26 | |

| 38 | Oil & Gas Producers | -8.8% | 3 | 37 | 34 | |

| 39 | Fixed Line Telecoms | -12.6% | 39 | 6 | 17 | |

Source: Thomson Reuters Datastream.

*To 3 April 2017.

The next table shows the sectors which made most progress up – and lost most ground by falling down – the performance rankings in February and March. The best performer is ranked one, the worst 39. As can be seen, Energy did consistently poorly (as above), while banks and miners lost momentum in the UK, just as they did globally.

The equity sectors showing the best and worst performing ranking momentum in the UK

| Sector performance ranking | |||||

| Biggest risers | End-Jan | End-Feb | End-Mar | Net rise | |

| Pharma & Biotech | 32 | 13 | 10 | 22 | |

| Aerospace & Defence | 28 | 11 | 12 | 16 | |

| Personal Goods | 16 | 1 | 1 | 15 | |

| Mobile Telecoms | 30 | 27 | 18 | 12 | |

| Sector performance ranking | |||||

| Biggest losers | End-Jan | End-Feb | End-Mar | Net fall | |

| General Industrials | 2 | 12 | 13 | 11 | |

| Mining | 1 | 4 | 16 | 15 | |

| Banks | 10 | 22 | 25 | 15 | |

| Food & Drug Retailers | 20 | 35 | 35 | 15 | |

| Tech Hardware | 18 | 17 | 37 | 19 | |

Source: Thomson Reuters Datastream.

*To 3 April 2017.

Investors with a domestic bias to their equity allocation will be looking for better from each of all three sectors in the rest of this year and beyond. If they fail to put in a better showing, UK stocks could again underperform their international peers in 2017.

Scores on the doors: fixed income

The hunt for some yield that is seen as safe, coupled with the poor showing from key cyclical sectors like financials and miners, may suggest that someone, somewhere has his or her doubts about the Trump/reflation trade – which takes us back to where we started.

There is no need to panic – after all stock and bond prices both remain near record highs and volatility is subdued. Yet it is exactly at such times, when making money looks easiest, that caution is warranted, as those who remember the peaks of 2000 and 2007 (or the volatility of 1987, 1994 and 1997-98) will attest, since this is when valuations are at their highest and therefore margins of safety in the event of a sudden shock at their lowest.

Keeping a balanced portfolio which satisfies investors’ overall strategy, target returns, time horizon and appetite for risk therefore feels like a sensible long-term plan, even if keeping a portion in fixed-income, and even cash or gold, may feel uncomfortable to many right now.

Russ Mould, AJ Bell Investment Director

Related content

- Wed, 17/04/2024 - 09:52

- Tue, 30/01/2024 - 15:38

- Thu, 11/01/2024 - 14:26

- Thu, 04/01/2024 - 15:13