Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

"Demand for oil seems to vary little over time and the commodity’s remarkable price inelasticity means that changes in crude are driven more by supply", says AJ Bell Investment Director Russ Mould.

"The rally forged by November’s OPEC and non-OPEC production cuts is a case in point but oil’s recovery seems to be waning, as Brent struggles to hold on to the $50-a-barrel mark and West Texas Intermediate already trades below $48.

"This means that investors who are exposed to oil and oil services stocks either directly or via funds, need to focus on three particular trends when it comes to gauging supply and assessing where the price of crude may go from here.

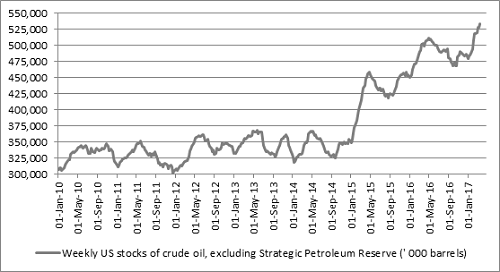

1. US oil inventories – new data out tomorrow

“These can be tracked every Wednesday via the website of the US Energy Information Administration.

“The surge in drilling activity has seen US oil inventories balloon once more. Energy Information Administration data shows stockpiles have risen 10 times in 11 weeks this year to 533 million barrels, up 6% year-on-year and 14% from the October low.

“Another increase tomorrow would suggest the market is in danger of becoming over supplied and could put further pressure on the oil price.

Source: Energy Information Administration

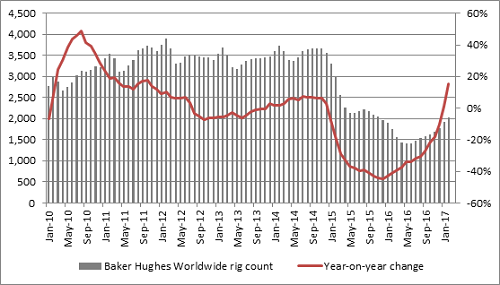

2. Oil rig counts

US

“One key feature of the last two years has been how the oil majors were quick to slash capital investment as the oil price plunged. Although OPEC has stuck to its production cuts, the US is not an OPEC member and production seems to be surging.

“The weekly Baker Hughes active rig count which has risen 80% from last year’s low to 789, the highest since October 2015, as shale producers crank up output (not least because many of whom are debt or junk-bond funded and need to keep pumping to bring in the cash they need to pay interest or the coupons)

Source: Baker Hughes

International

“Published by Baker Hughes on a monthly basis, this dataset shows a similar trend to the US numbers, namely higher activity following the collapse of 2016. The 45% increase in working rigs since the trough is at least less dramatic than that seen in the US, perhaps reflecting the discipline imposed by OPEC’s production cut.

Source: Baker Hughes

3. Speculative trading positions

“In the very short term, there is one other factor which may also be influencing crude and this is the role played by financial traders and (for want of a better word) speculators.

“Data from the Commodity Futures Trading Commission (CFTC) suggests that speculative buyers are still very active in crude, with non-commercial ‘long’ open futures contract positions (where the trader believes oil is going to rise) outnumbering non-commercial ‘short’ open futures contract positions (where the trader believes oil is going to fall) by 433,000 contracts (each contract is 1,000 barrels of oil).

“Since traders already seem to be hugely net long after a big oil surge from below $30 it may be hard to find incremental buyers, especially as the consensus seems to be OPEC will stick to its production cuts and that major non-OPEC player Russia will too, while the burgeoning inventories suggest the market is oversupplied. A reduction in traders’ net ‘long’ position has coincided with the recent retreat in oil so for oil to hit bottom we may need to see more speculators flush out their positions.

“This is a classic case of how positioning and leverage (as many of these contracts will be traded on margin, using only a small initial deposit of money rather than the full sum) frequently dictate short-term market action, whereas industry fundamentals will play out in the longer term.”

Source: Thomson Reuters Datastream, CFTC

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05

- Wed, 20/03/2024 - 16:30