Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“Next’s full-year results lived down to the low expectations set by January’s profit warning as (underlying) pre-tax income fell 4% to £790 million and management maintained guidance with a mid-point range of £730 million, a further 8% drop," says AJ Bell Investment Director Russ Mould.

“Management cited tough High Street conditions and margin pressure owing to the weaker pound, higher rates and the National Living Wage but did also admit to having dropped the ball when it came to its product range.

“In an attempt to instil a speedier buying culture, and presumably boost stock turn and thus margins (a model used to great effect over the years by TopShop), Next managed to omit some of its best-selling lines, unwittingly reducing sales.

“Next is already working to boost the availability of popular product, pushing through £26 million of cost savings to help mitigate the £36 million cost increase and is already offering guidance which covers these issues and the drop in sales that it believes will result from price hikes of 4% to 5% designed to cover rising raw material costs.

“As such the outlook statement does not feature another profit warning and the absence of fresh bad news is one source of support today for a share price which has fallen from £80 to £42 and a stock which has de-rated from an 18 times multiple of all-time high profits to barely ten times depressed profits.

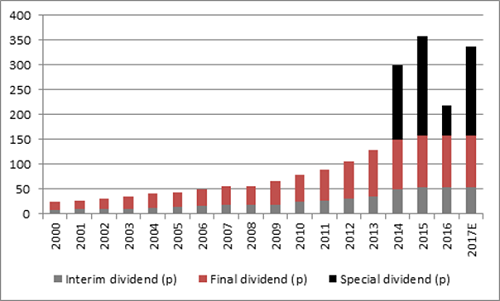

“In addition, the company is still churning out dollops of surplus cash. Although a long run of increases in the ordinary dividend ended in 2016, as Next announced an unchanged total pay-out of 158p, the company is planning to offer four 45p-a-share special dividends in 2017, on top of the ordinary distribution.

“Assuming that is again left at 158p, then a 338p-a-share total distribution equates to a dividend yield of 8% on the £42 share price, a sum which will exceed every stock in the FTSE 100 bar National Grid, once taking into account special dividends.

Source: Company accounts and for 2017 consensus analysts’ forecasts and management guidance.

“If there is one real disappointment in the Next results it concerns the share buy-back programme.

“Management spent £188 million of shareholders’ money on them in 2016 at prices ranging from £56.42 to £46.49, £151 million in 2015 and £138 million in 2014 (when the shares were higher still) but has elected not to make any repurchases in 2017 – even though the shares are now cheaper, in terms of the price but also the multiple of earnings on which they are trading.

“Any fund manager doing that would face some very serious questions and this again raises doubts over the value that share buy-backs provide to investors.

“As Warren Buffett puts it in his Letter to Shareholders for 2016, share buybacks make sense – but only when a firm does not need the money to invest in its core proposition and competitive position, when debt is not used to the lasting detriment of the balance sheet and when the shares are bought cheaply and below intrinsic value.

“When even a firm that is as well run as Next starts to lose its nerve, despite having clearly outlined previously levels at which it was prepared to buy shares and levels at which it was not, then investors do need to approach buybacks with care and a degree of healthy scepticism.”

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05

- Wed, 20/03/2024 - 16:30