Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“A 5%-plus share price rise at the opening in Sainsbury’s shares reflects both investor’s delight to see a return to like-for-like sales growth at the core supermarket business and also a strong showing from the newly-acquired Argos operation, numbers which start to vindicate boss Mike Coupe’s 2016 swoop for the catalogue retail business.

“Following in the footsteps of sector rival Morrison’s yesterday, Sainsbury unveiled strong Christmas trading as like-for-like sales for the third quarter overall rose 0.1%, excluding fuel, ending a dismal run of year-on-year falls.

“Coupe noted that the firm had its best Christmas week ever, attracting 30 million customers and pulling in £1 billion in sales compared to analysts’ forecasts for the whole financial year of £25.7 billion, so that is 4% of the group total in barely 2% of the time available.

“Sainsbury flagged strong online and convenience sales, up 9% and 6% respectively, both key points of differentiation from Morrisons, while to the chagrin of shareholders in Next the firm joined Morrisons in flagging strong clothing sales.

“Sales at Argos rose 4.1% in total and 4% on a like-for-like basis, exceeding analysts’ expectations, helped by the roll-out of digital stores and click-and-collect points within Sainsbury’s supermarkets.

“It is still early days – and for those who believe that life begins to the left of the decimal point, a 0.1% increase in like-for-like sales at the supermarket operation is no big deal – but at least Sainsbury is generating some positive momentum.

“This is a welcome change – Sainsbury even cut its interim dividend from 4.0p to 3.6p back in the autumn – and it may be enough to stir interest from investors, especially as the company is one of the battalion of domestically-focused stocks which have largely been ignored by the post-Brexit market rally.

“Even on relatively depressed earnings, Sainsbury trades on around 13.5 times earnings with a 3.7% yield.

“Given the still-modest growth and substantial risks associated with not just the Argos deal but the dangers of a weak pound and fierce industry-wide competition, plus concerns over what an eventual Brexit could mean for consumer spending and the wider UK economy, a discount rating to the market (on 15 times) seems appropriate, while the yield is a bit lower than that of the FTSE 100.

“As such Sainsbury’s valuation seems fair for now, but if Coupe’s Argos deal does help to revive growth and drive earnings higher then there is scope for both earnings forecast upgrades and an upward re-rating of the stock.

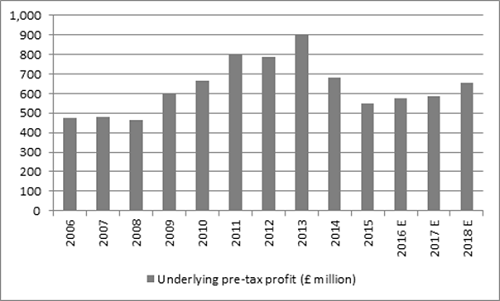

Source: Company accounts, Digital Look, analysts' consensus forecasts

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05