Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“Bovis’ post-Christmas profit warning may have rocked the house builders’ sector but Persimmon’s trading statement today offers some reassurance, especially as it comes quickly on the heels of yesterday’s strong construction purchasing managers’ index reading and an eight-month high in the Bank of England’s mortgage approvals data,” says Russ Mould, Investment Director at AJ Bell.

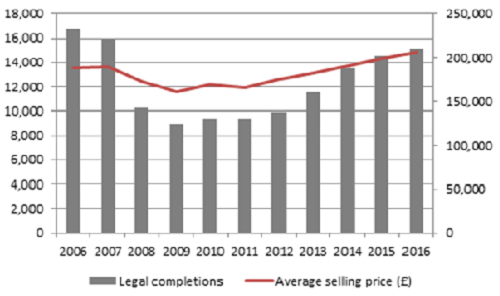

“Persimmon flagged a 4% rise in legal completions and a 4% rise in average selling prices and – perhaps most encouragingly – a 12% jump in its forward sales book to £1.2 billion, enough to put the stock at the top of the FTSE 100 leader board in early trading, with a 3.3% gain.

“Volumes remain below the 2006 peak although prices set a new high, to suggest that demand continues to outstrip supply, especially as mortgage approvals have bounced back from their pre- and post-EU referendum lull.

“This strong price trend has helped Persimmon to add to its net cash pile, which has surged from £570 million to over £900 million during the year. This underpins the company’s plan to return 110p a share in cash to shareholders via special dividends every year until 2021.

“That is enough for a 5.8% dividend yield and their potential attraction to income investors forms a strong part of any potential investment case for the builders, whose shares still trade well below their 12-month highs.

“The key question for investors now is whether the earnings and dividend forecasts are reliable. If so, Persimmon and the other house builders look cheap, trading on single-digit price/earnings ratios which in some cases are hardly higher than their forecast dividend yields.

“Yet such tempting valuations are sometimes the first sign a stock is a value trap and the combination of low PEs and fat yields suggests the market does not believe the earnings forecasts (see table below).

“The challenge in 2017 Persimmon and the other house builders is therefore to prove that Brexit, rising Government bond yields and bubbly house prices are not going to puncture the housing market.

“All eyes will now switch to the trading statements that are due next week from FTSE 100 house builders Taylor Wimpey and Barratt Developments.”

PE (x) |

Dividend yield (%) |

|

7.4 x |

7.4% |

|

7.1 x |

7.0% |

|

7.4 x |

5.5% |

|

7.5 x |

5.9% |

|

9.7 x |

5.8% |

|

7.5 x |

2.8% |

|

8.9 x |

7.2% |

|

8.8 x |

4.9% |

Source: Digital Look, consensus analysts' forecasts. Based on share prices at open on Thursday 5 January 2017.

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05